In this post I share the details about property taxes in Morocco that every home owner is required to pay.

When we used to live and own a house in New York state, every year we paid property and school taxes. The collected property tax funds local projects and services: fire departments, law enforcement, local public recreation and libraries. The school tax as the name implies, helps fund public schools. Every property owner needs to pay those two taxes even if they don’t have kids in school. Those taxes can be high but usually they can be deducted from one’s taxable income: they are considered an expense that an individual taxpayer or a business can subtract from adjusted gross income while completing their income tax reporting every year. What about Morocco ?

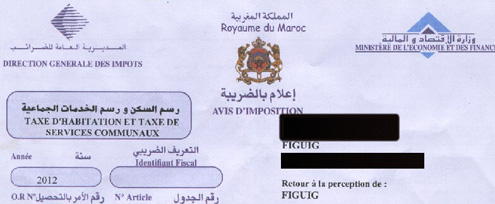

In Morocco as a property owner there are two recurrent yearly taxes: housing tax and communal services tax. As we moved to Morocco and we own a home, I needed to understand the property taxes in Morocco and how they are assessed. Let’s begin with the housing tax before discussing the communal services one.

Housing Tax

Homeowners are exempt from paying the housing tax during the first five years of ownership for new homes. This exemption does not apply to used homes. One nice feature of this tax is there is a 75% tax reduction if the house is one main residence.

The 75% discount applies to Moroccan nationals residing abroad using their property as their main residence or if the property is occupied free of charge by a family member (spouse, children, etc.). They benefit, as well, from the 75% tax reduction. We will get into the details of this reduction in the next paragraphs.

The housing tax is computed as a percentage of the assessed annual rental value. If the assessed rental annual value is 5000 dh or less, the tax is 0% of the assessed value; hence 0 dh. As assessed rental value increases, the tax percentage increases as follows:

| Annual assessed rental value | Rate | Amount to be deducted |

| 0 to 5000 DH | Exempt | – |

| 5001 to 20 000 DH | 10% | 500 DH |

| 20 001 to 40 000 DH | 20% | 2500 DH |

| 40 001 DH and + | 30% | 6500 DH |

The formula for calculating the housing tax is:

Housing Tax = (Annual assessed rental value x Rate ) – Amount to be deducted

Once you know the assessed monthly rental value, you can then calculate the annual value (multiplying it by 12 months). Using the annual value and eventually a 75% discount (if main home), use the above table to figure out the tax rate and the amount to be deducted.

Let’s use two different houses and calculate their housing taxes.

Example 1: Appartement with 1500 dh assessed monthly rental value

Consider an appartement’s assessed monthly rental value is 1500 dh. Annually, this means 18000 dh (1500 dh * 12 months). Before we find what tax rate we fall into, we need to discount 75% from the annual assessed rental value if the house is a principal residence.

| Main residence | Secondary residence | |

| Annual rental value | 18 000 DH | 18 000 DH |

| 75% reduction | 13 500 DH (0.75 x 18000) | 0 (no deduction for secondary house) |

| Taxable base | 4500 DH (18 000-13 500) | 18 000 DH |

| Rate | 0% (as taxable base is less than 5000 dh) | 10% |

| Taxe | 4500 x 0% = 0 DH | 18 000 x 10% = 1800 DH |

| Amount to be deducted | 0 DH | 500 DH |

| Tax to be paid | 0 DH | 1800 – 500 = 1300 DH |

If the house above was our main residence, there would not be any habitation tax. The taxable base is 4500 dh, being less than 5000 dh; their tax rate is null.

However, if the above house was a secondary home, we we’d need to pay 1300 dh annualy.

Example 2: Appartement with 5000 dh assessed monthly rental value

Consider an appartement’s assessed monthly rental value is 5000 dh. Annually, this adds up to 60000 dh (5000 dh * 12 months).

| Main residence | Secondary residence | |

| Annual rental value | 60 000 DH | 60 000 DH |

| 75% reduction | 45 000 DH | 0 (no reduction for secondary house) |

| Taxable base | 15 000 DH (60 000-45 000) | 60 000 DH |

| Rate | 10% | 30% |

| Taxe | 15 000 x 10% = 1500 DH | 60 000 x 30% = 18 000 DH |

| Amount to be deducted | 500 DH | 6500 DH |

| Tax to be paid | 1500 – 500 = 1000 DH | 18 000 – 6500 = 11 500 DH |

Notice that a main residence is treated favorably by the tax code, while a secondary one is not. Another important point, the assessed rental value is determined by the taxation administration (Direction Générale des Impôts). Usually when you buy a home, the last step of the buying transaction is to register your property with the taxation administration. This way you can receive by mail the housing and communal services taxes bill every year.

During the buying transaction process, you can ask the notary or the seller about how much taxes they pay every year. Or simply inquire directly at the taxation administration about the tax figures or the assessed rental value. Note that the assessed rental value could be different from the real rental value.

Important points

Before moving on to the communal services tax, there are two points that I think are important to mention:

- If you have a secondary house and you provide it rent free for your parents, siblings, kids or your wife to live in it, the 75% discount is applied to the assessed rental value and the house is treated like a principal residence for housing tax purposes.

- The assessed rental value increases by 2% every 5 years.

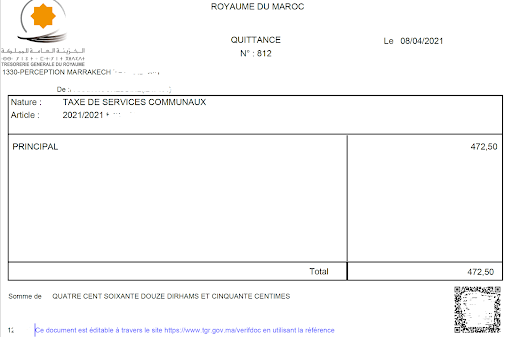

Communal Services Tax

This tax replaces the old municipal tax called “taxe d’édilité” and it’s due starting the first year of property ownership. This tax, like the housing one, is also a percentage of the assessed annual rental value of the house, except that the percentage is fixed: 10.5% for urban locations and 6.5% for not-urban locations.

Example 1: Appartement with 1500 dh assessed monthly rental value

Consider the same apartment as in housing tax example 1. It’s assessed monthly rental value is 1500 dh: 18000 dh annually.

| Main residence | Secondary residence | |

| Annual rental value | 18 000 DH | 18 000 DH |

| 75% reduction | 13 500 DH | 0 |

| Taxable base | 4500 DH (18000-13500) | 18 000 DH |

| Rate | 10.50% if urban, otherwise 6.5% | 10.50% if urban, otherwise 6.5% |

| Tax calculation | 4500 x 10.50% (if urban location) 4500 * 6.5% (if not urban location) | 18 000 x 10.50% (if urban location) 18 000 x 6.50% (if not urban location) |

| Tax | 472.5 DH (if urban location) 292.5 DH (if not urban location) | 1 890 DH (if urban location) 1 170 DH (if not urban location) |

Example 2: Appartement with 5000 dh assessed monthly rental value

Consider the same apartment as in housing tax example 2. It’s assessed monthly rental value is 5000 dh: 60000 dh annualy.

| Main residence | Secondary residence | |

| Annual rental value | 60 000 DH | 60 000 DH |

| 75% reduction | 45 000 DH | 0 |

| Taxable base | 15 000 DH | 60 000 DH |

| Rate | 10.50% if urban, otherwise 6.5% | 10.50% if urban, otherwise 6.5% |

| Tax calculation | 15 000 x 10.50% (if urban location) 15 000 * 6.5% (if not urban location) | 60 000 x 10.50% (if urban location) 60 000 x 6.50% (if not urban location) |

| Tax | 1 575 DH (if urban location) 975 DH (if not urban location) | 6 300 DH (if urban location) 3 900 DH (if not urban location) |

Payment deadlines and how to

Housing and communal services taxes come in the same statement bill every year and they are due by the end of Mai each year. You don’t want to delay paying those taxes as passing the due date there are fines. Payment can be made online using the Trésorerie Générale du Royaume (TGR) website or any of the following methods:

- ATM machines (no cost)

- Your Moroccan bank mobile app (no cost)

- TGR mobile app (no cost)

- Your Moroccan bank teller service (15 dh fee)

- Local payment shops (15 dh fee)

- TGR bureau (“Perception”) (no cost)

Personally, I just use my Moroccan bank app to pay my property taxes. It takes a minute or two each year and I’m done with it. Once paid, I get the receipt and keep a printed copy for my records.

If you pay these taxes, what would be your preferred method of payment ? Any issues you encountered paying property taxes or assessing their figures ? If you have any questions, feel free to ask in the comments section and I’ll try my best to answer it.

————————————————————————————————————-

Reference: Direction Générale des Impôts, 2010 – Taxe d’Habitation et Taxe de Services Communaux

Subscribe